Surprise! Up to 90% of all new taxes in the Biden inflation bill could come from small businesses making less than $200k per year

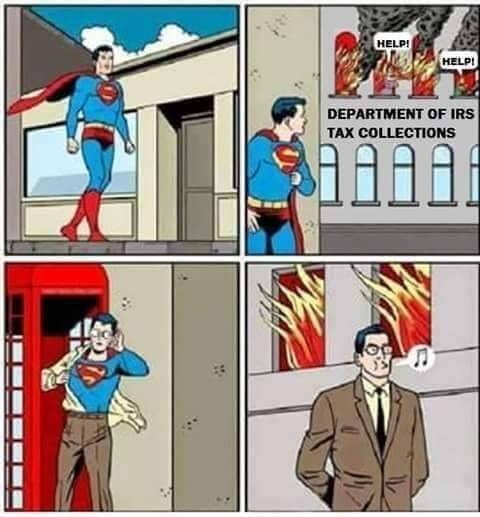

Small business owners may soon be in for a lengthy and expensive battle with the IRS, tax experts warn.

A key provision in the Inflation Reduction Act — which throws an extra $80 billion to the IRS to improve the agency’s collection of under-reported income — will end up targeting small business owners to pay for the legislation, according to nonpartisan watchdog the Joint Committee on Taxation.

The group estimates that between 78% and 90% of the estimated additional $200 billion the IRS will collect will come from small businesses making less than $200,000 annually.

You may not be aware of it, but there are perverse incentives for the IRS to go after lower earners:

“The IRS will have to target small and medium businesses because they won’t fight back,” Joe Hinchman, executive vice president at National Taxpayers Union Foundation, told The Post. “We’ve seen this play out before … the IRS says ‘We’re going after the rich’ but when you’re trying to raise that much money, the rich can only get you so far.”

In fact, going after the lower and middle class can actually be more lucrative for IRS auditors than trying to get more money from the wealthy. “The rich have their lawyers and fight it — that’s why the poor are easier to go after,” Hinchman adds.